Often the primary long-term goal of business ownership is to increase personal wealth to achieve financial independence. Wealth can consist of non-financial assets valued to show a high net worth. But financial independence requires liquidity. Liquidity is achieved when readily available liquid assets are held at a low risk of loss. Non-financial assets such as home equity and business equity are non-liquid and held at risk, as are financial assets such as stock and bond portfolios. How does the business owner reach this goal of financial independence? The simple and direct answer is to sell the business interest to convert non-liquid business equity to liquid assets.

A substantial amount of family wealth is in business ownership. In 2019, non-financial assets represented a 58 percent share of total assets. Business equity was 34 percent of non-financial assets, second to primary residence’s 45 percent share. As net worth increases so does the probability that families have business equity: 45 percent of families in the top 10 percent of net worth had business equity, 23 percent for the 75 to 89 percentile, 14 percent for the 50 to 74 percentile, 5 percent for the 25 to 49 percentile, and 3 percent for the bottom 25 percentile. (Source: Federal Reserve Board, Survey of Consumer Finances).

The way to convert a illiquid non-financial asset such as business equity to a liquid asset is to sell the asset and invest the proceeds in a liquid investment – an investment that allows access to funds on a readily available basis. Therefore, if the primary goal of business ownership is to increase personal wealth to achieve financial independence, reaching that goal will involve selling the business ownership interest and placing the proceeds into a liquid investment.

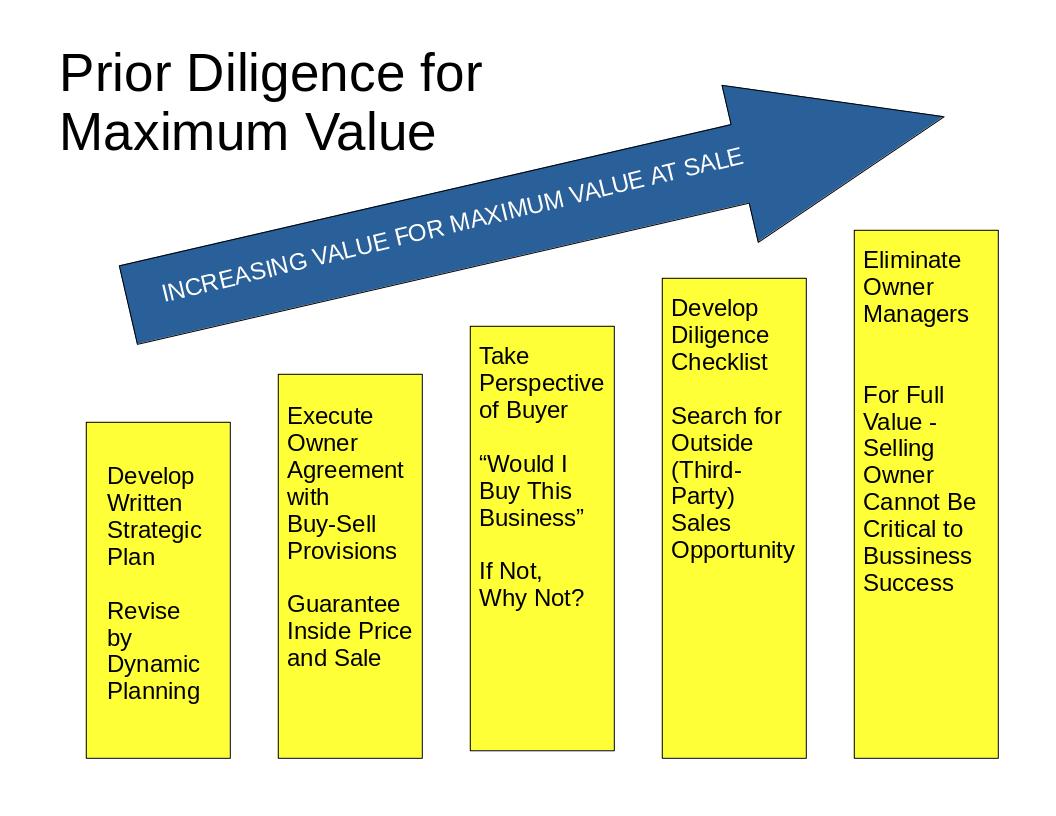

As the owner of a business, it is a good practice to ask: “If I were thinking of buying this business, what would keep me from closing?” Be objective and play the role of an investor who is sophisticated and looking for a business interest to purchase. If you were that person, knowing what you know about your business, would you buy the business interest you own? If not, why not? More importantly, what can be done to correct the problems that prevent your business interest from being marketable? Do your competitors have the same problems?

The more you prepare to sell your business, the more it will be worth when the business interest transfers. This perspective is prior diligence, a unique method for analyzing your business. Manage your business to be ready for sale at the highest value.

When you offer an item for sale, you clean it up and make the item look as good as possible. You now do the things that before seemed not to be important, such as cleaning or deferred maintenance. Of course, this is not good management – it would have been better to constantly keep the item clean or to not defer maintenance. Deferring maintenance frequently causes problems later. When a crisis occurs, it is the items subjected to deferred maintenance that malfunction and cause the crisis level to increase. Prior diligence is a better way to manage by anticipating a sale.

A potential sophisticated buyer doing a diligence review of the business will investigate business entity status (including minutes of meetings and decisions as well as compliance with entity registration requirements), owner agreements (including management agreements, buy-sell agreements, and voting agreements), regulatory matters (including having in place necessary permits, licenses, and other filings), facilities (including all leases and use agreements), employment issues (including compliance with Fair Labor Standards Act categories, employee manual, employment agreements, confidentiality agreements, non-compete agreements, personnel files, compensation histories, and benefits plans with related records), the balance sheet (including inventory of assets, documentation of title, records of encumbrances, and intellectual property), insurance (including nature of coverage and evaluation of risks not insured), financial (including accounting, loan agreements, and management reports), tax (including federal income tax, state income tax, use or sales tax, and other taxes such as property tax), environmental status (including past surveys done and consent decrees), and legal issues (including existing and contemplated contracts.

After the diligence investigation, and most important for the buyer, is the projected operation of the business after closing. An important component of managing the business for sale for maximum value is recognizing that the presence of owner-managers involved in the business decreases the value of the business. Will the buyer have to keep the services of the owner to have the business operate properly after the sale? If so, the buyer will pay less for the business. As a part of prior diligence, create non-owner management so that owner-managers are not essential to the business.

From your knowledge of your own business and your anticipation of what a potential buyer will investigate, you can create a diligence checklist.

Manage the business for sale for maximum value by working on creating non-owner management so owner-managers are not essential to the business and completing in a timely fashion the management functions of maintaining the business. Conduct your own diligence investigation on a regular basis. This is managing for the sale. By the way, there is nothing that says you have to sell, just because you manage for the sale. Your business will still be worth more when you do decide to sell.